Bear markets do happen from time to time. Your portfolio—is it ready? With these seven investing strategies, get ready.

Long-lasting bull markets are possible, but they are not limitless. Additionally, it is preferable to be ready rather than caught off guard when a bull stops rushing. Then how do you get ready?

These are the seven actions to take:

Table of Contents

1.Know that you have the resources to weather a crisis

According to Mark Riepe, executive director of the Schwab Center for Financial Research, “some consumers worry in a bear market because they don’t know whether they have enough cash to handle near-term goals.” In an ideal world, you won’t need to know the answer to this question when a crisis arises.

Mark believes that if you’re retiring, having the next 12 months’ worth of living expenses in a bank account or money market fund, as well as a couple more years’ worth in bonds that mature when you need the money, can help you stay composed and rational.

“If you get caught off guard and have never set up that foundation, your response will be very different from theirs. Your capacity to emotionally withstand significant price swings and losses—your risk tolerance—is only one factor “He adds. “It has to do with your ability to take on financial risk. Can you afford to suffer a loss, in other words?”

Even though you may consider yourself to be risk-tolerant, if your investments are not set up to withstand a rapid decline, you may need to make difficult lifestyle changes if a crisis arises.

2.Match your money to your goals

Make a strategy that takes into account the expenses you have coming up as well as your long-term financial objectives, such as retirement or education costs. Create a portfolio that is tailored to these objectives. The best places to put money that you’ll need soon or that you can’t afford to lose—like the down payment on a house, for instance—are in investments that are relatively stable, such Treasury bills, money market funds, or certificates of deposit (CDs).

Investment-grade bonds and CDs should be used to finance goals that must be paid for within the next three to five years. Consider investing in assets with growth potential, such as equities, which are riskier, for money you won’t need for five or more years.

3.Remember: Downturns don’t last

The typical bull market lasted for nearly six years and produced an average cumulative return of over 200%, according to research conducted by the Schwab Center for Financial Research on both bull and bear markets for the S&P 500 Index going back to the late 1960s. The typical bear market experienced a loss of 38.4% over the course of about 15 months. The longest of the bear markets lasted slightly longer than two years, and a bull market that lasted over five years followed. The pandemic-driven bear market that began in early 2020 was the shortest, lasting just 33 days.

Past bear markets have tended to be shorter than bull markets

What effect will this have on your bear market kit? Even if a bear market is about to enter its second year, keep in mind that it won’t persist. No bull market, just as no bad market, lasts forever. Additionally, historically, market uptrends have outlasted long-term downturns.

4.Keep your portfolio diversified

Is there a solution to help your portfolio get back on its feet if there is a slump?

A good diversification strategy can provide protection from losses. It is conceivable that some market segments are struck more harder than others during a bear market. Since it is very impossible to predict these in advance, diversifying both within the equity market and among different asset classes can be done now as a precautionary measure.

Take into account the resources you’ve set aside for medium-term objectives or needs. In order to be diversified, you must have a wide range of investment-grade bonds, including corporate, municipal, Treasury, and possibly overseas issues. Additionally, they ought to have a range of maturity dates, from short-term to mid-term, so that you always have bonds that are about to mature and provide you with income or capital to reinvest.

According to Mark, you should distribute your long-term assets among a variety of domestic equities, including both large and small, dividend-paying businesses with rapid growth, as well as foreign stocks, real estate investment trusts (REITs), and commodities. According to him, this combination exposes you to asset classes that frequently fluctuate at various rates and intervals.

5.Don’t miss out on market rebounds

When the markets are close to all-time highs, it is simple to claim that risk doesn’t concern you, says Mark. “How you conducted yourself throughout the past downturn is a stronger signal,”

In March 2009, when the market was at its lowest point, many investors sold, converting transitory paper losses into actual, wealth-depleting losses. The Investment Company Institute estimates that in that month, outflows from mutual funds were around $21.6 billion. Investors who delayed returning to the market would have missed the start of one of the most powerful bull markets in history.

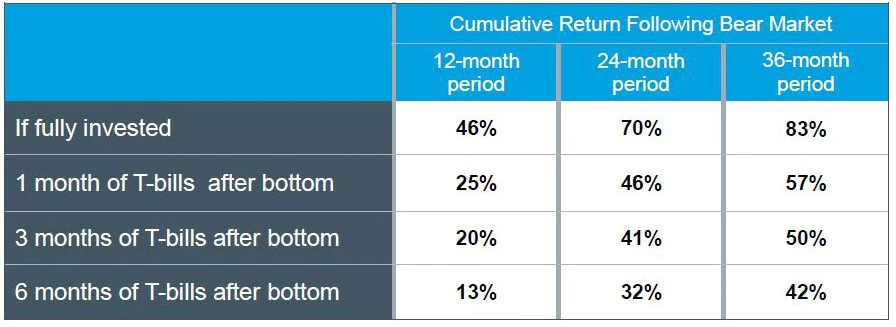

The returns from four fictitious portfolios were compared by the Schwab Center for Financial Research in order to obtain a sense of what is at risk when you exit the market, even briefly, during the typical bear market:

- One that didn’t change its stock holdings at all during the market’s bear market low and subsequent recovery. (Although we advise diversifying your portfolio with a range of investments suitable for your objectives and risk appetite, we’re concentrating on stocks here to highlight the effect of market timing.)

- After the market bottomed, one that was switched to short-term T-bills for a month before going back to a 100% stock allocation.

- After the market peaked, one that was switched to T-bills for three months before going back to a 100% stock allocation.

- After the market peaked, one that was switched to T-bills for six months before going back to a 100% stock allocation.

The all-stock portfolio was the greatest performer, and three years after the market bottomed, it was still generating better returns than the other portfolios, as seen in the table below. At the very bottom of the market cycle, however, participants in that all-stock portfolio were required to maintain their positions. People who waited until the situation improved (for example, a month after the cycle’s low point, three months, or even six months later) nevertheless took part in the recovery, although at a much lower rate.

Bear market recoveries are often front-loaded

Riding out a bear market could be worthwhile if you can handle it because timing the market is exceedingly difficult because no one can predict when the bottom will occur.

6.Include cash in your kit

Despite being one of the lowest-returning asset types, cash has the potential to diversify your portfolio over the long run. Cash can act as a hedge against volatility because of its extremely low connection to other asset classes. Another benefit is that having cash on hand might be useful in unstable markets. If you have cash on hand, you can invest when prices are at an alluringly low position without having to sell your stocks at a loss. Cash can therefore offer your portfolio some flexibility and stability (low volatility and correlation) (to buy new investments without selling old ones cheap).

7.Find a financial professional you can count on

Last but not least, having a built-in buddy system for your bear market kit might be advantageous. In other words, you should find a financial expert you can trust to work with you if you’re unsure of how to organize your portfolio properly or you believe you’d be inclined to act hastily during a market decline. That person can assist you go through a thorough portfolio assessment and get yourself and your portfolio ready for periods when the market is difficult.

Frequently asked questions

What investments do well in a bear market?

Consumer goods and utilities typically fare better in bad markets than other things. Through index funds or exchange-traded funds that follow a market benchmark, you can invest in particular industries.

How do you make money investing in a bear market?

If the share price falls, you can buy those shares at a discount to cover your short position and benefit from the price difference.

How long will this bear market last 2022?

The S&P 500 entered a bear market on January 3, 2022, while the bear market was officially declared on June 13, 2022. Using this date as the formal beginning of the current bear market, a bear market with an average duration of 289 days would end on October 19, 2022.

Editor’s choice:

“What Is a Bear Market and How Should I Invest During One?”03rd Topic Is Best

Leave a Reply

You must be logged in to post a comment.