Hollywood movies, news programs, and television all presuppose that you are familiar with the stock market and its operations. Everyone is aware that the stock market may be a lucrative venture if you know what you’re doing, but novice investors frequently lack a thorough understanding of how the market operates and the precise reasons why equities rise and fall.

Before you begin investing, you should be aware of the following stock market information.

Table of Contents

What is the stock market?

The collection of stocks that the general public can buy and sell is referred to as the stock market. People who own stock in a corporation can sell their shares to other investors on the stock market, which is essentially a type of aftermarket. Naturally, a brokerage account is a prerequisite for stock investment.

“How to invest in the stock market” 8 tips for beginners

- Buy the right investment

- Avoid individual stocks if you’re a beginner

- Create a diversified portfolio

- Be prepared for a downturn

- Try a simulator before investing real money

- Stay committed to your long-term portfolio

- Start now

- Avoid short-term trading

1. Buy the right investment

Buying the right stock is lot easier to say than it is to really do. Anyone can look at a stock that has performed well in the past, but predicting how a stock will perform in the future is considerably more difficult. If you want to be successful investing in individual stocks, you must be prepared to put in a lot of work to manage your money and research businesses.

TIAA’s chief financial planning strategist, Dan Keady, CFP, claims that “It’s important to keep in mind that when looking at statistics, experts are likely looking at each and every one of those organizations with a lot more rigor than you can. As a result, winning the game over time is highly challenging for the person.”

When analyzing a firm, you should take into account its fundamentals, such as its price-earnings ratio (P/E ratio) or earnings per share (EPS). The management team of the company should be investigated, together with its competitive advantages and financial information, particularly the income statement and balance sheet. These are barely the beginning, even.

According to Keady, buying stock in your favorite firm or product on the open market isn’t the best method to invest. Additionally, remember that previous performance is no guarantee of the future, so don’t place too much stock in it.

It will be difficult even in good times to analyze the business and predict what will happen next.

2. Avoid individual stocks if you’re a beginner

Everyone has heard someone discuss a significant stock gain or a wise stock selection.

What they frequently overlook, according to Keady, is the fact that they aren’t discussing the specific investments they also hold but which performed horribly over time. Therefore, occasionally, people have irrational expectations about the kinds of profits they may get in the stock market. Furthermore, they occasionally mix together skill with luck. It’s possible to strike it lucky while choosing a specific stock. Being fortunate over time while avoiding those severe downturns is difficult.

Remember that in order to consistently profit from specific equities, you must possess information that the market’s forward-looking pricing does not already reflect. Remember that there is a buyer for every seller in the market who is equally confident they will make a profit.

The likelihood of you surpassing that is not very good if you’re a newbie, according to Tony Madsen, CFP, proprietor of NewLeaf Financial Guidance in Redwood Falls, Minnesota. “There are loads of brilliant individuals doing this for a job,” he adds.

Always keep in mind that you need to have information that the market isn’t currently pricing into the stock price in order to continuously profit from specific equities. Remember that there is a buyer in the market who is just as confident they will profit for every seller in the market.

According to Tony Madsen, CFP, proprietor of NewLeaf Financial Guidance in Redwood Falls, Minnesota, “there are a ton of clever people doing this for a job, and if you’re a rookie, the likelihood of you surpassing that is not very good.”

3. Create a diversified portfolio

The fact that an index fund includes a variety of equities right away is one of its main benefits. For instance, if you purchase equities in a broadly diversified fund based on the S&P 500, you will have exposure to hundreds of companies in numerous industries. But you might alternatively invest in a fund that is just narrowly diversified and that focuses on one or two industries.

Diversification is crucial because it lowers the likelihood that any single stock in the portfolio will significantly detract from overall performance, which actually increases overall returns. In contrast, if you only purchase one stock, you are effectively putting all of your eggs in that one basket.

Purchasing an ETF or mutual fund is the simplest approach to build a diverse portfolio. You don’t need to conduct any investigation on the businesses contained in the index fund because diversification is already incorporated into the products.

It might not be the most thrilling, but Keady says it’s a good place to start. And once more, it disabuses you of the notion that you’re going to be so wise that you’ll be able to choose the stocks that are going to go up, won’t go down, and know when to go in and out of them.

Diversification is more than just owning a variety of stocks. Because stocks in comparable industries may move in the same direction for the same reason, it also refers to investments that are spread out over several asset classes.

4. Be prepared for a downturn

The hardest hurdle for the majority of investors is taking a loss on their investments. The volatility of the stock market will result in losses on occasion. To handle these losses, you’ll need to be resilient; otherwise, you’ll panic and purchase high and sell low.

Any single stock you hold shouldn’t have a significant impact on your overall performance as long as you diversify your portfolio. Purchasing individual stocks might not be the best option for you if it does. No matter how hard you try, even index funds will vary, so you can’t completely eliminate risk.

According to NewLeaf’s Madsen, “We have this tendency to attempt to pull back or to second-guess our readiness to be in” if the market changes.

Because of this, it’s critical to be ready for sudden downturns, like the one that occurred in 2020. To earn enticing long-term returns, you must endure short-term volatility.

Since stocks don’t have principal guarantees, it’s important to understand that investing carries the risk of financial loss. A high-yield CD can be preferable if you’re seeking for a guaranteed return.

Keady warns that it might be challenging for novice and even seasoned investors to comprehend the idea of market volatility.

People will see the market is volatile because it is declining, which is one of the exciting aspects, according to Keady. “Of course, it’s equally volatile while it’s going up, at least statistically speaking; it’s moving all over the place. People should emphasize that the volatility they are observing on the upside will also be there on the downside.

5. Try a stock market simulator before investing real money

Using a stock simulator is one method to enter the world of investing without taking any risks. Your real money is not at danger if you use a virtual trading account on the internet. You’ll be able to decide how you would respond if you actually had the money to gain or lose.

According to Keady, “it can be incredibly beneficial because it can help people get over the idea that they’re smarter than the market.” “That they can always choose the best stocks, buy, and sell at the proper times in the market.”

Considering your reasons for investing will help you decide if stock investing is right for you.

It could be a good idea to use a simulator or observe some stocks to see if you could truly accomplish it, advises Keady, if your plan is to somehow outperform the market and choose all the top stocks. “Then I think you’re far better off – virtually all of us, including myself – to have a diverse portfolio such as given by mutual funds or exchange traded funds,” he continued. “If you’re more serious about investing over time, then I think you’re better off.”

6. Stay committed to your long-term portfolio

According to Keady, investing should be a long-term endeavor. Additionally, he advises you to cut yourself off from the 24-hour news cycle.

You’ll be able to cultivate patience by avoiding the daily financial news, which you’ll need if you want to continue in the investment game for the long run. Additionally, it helps to only glance at your portfolio occasionally to prevent over-anxiety or over-elation. These are excellent pointers for novice investors who haven’t yet learned to control their emotions.

According to Keady, there are moments when the news cycle is completely negative and overwhelms individuals.

Setting up a calendar and deciding in advance when you’ll be analyzing your portfolio is one method for novices. Following this rule will prevent you from selling out of a stock during times of market turbulence or from not reaping the full rewards of a successful investment, according to Keady.

7. Start now

Waiting for the perfect time to buy in the stock market typically doesn’t work well. Nobody can definitively predict the ideal time to enter. Investment is also a long-term endeavor. There is no perfect time to start.

One of the most important things about investing, according to Keady, is to start rather than just think about it. And now, begin. Because compounding is what can really boost your profits if you invest now and frequently throughout time. It’s crucial to actually start investing and have a savings program in place so that we can eventually attain our objectives.

8. Avoid short-term trading

Knowing whether you are investing for the long run or the short term can also assist you decide on your approach and whether you even need to be investing. Short-term investors can have irrational expectations about their ability to expand their money. And studies indicate that the majority of short-term investors, including day traders, lose money. You’re up against powerful investors and smart computers that might know more about the market.

New investors should be aware that regularly purchasing and selling stocks might be costly. Even though a broker advertises a zero headline trading commission, it might nevertheless result in taxes and other expenses.

You run the danger of not having your money when you need it if you invest for the short term.

Anything less than a couple of years, and perhaps even three years out, Madsen says, “I’m cautious to assume too much market risk with those monies.”

A savings account, money market account, or short-term CD may be preferable options for short-term money, depending on your financial objectives. Investors are frequently advised by experts to only make stock market investments if they can maintain those investments for a minimum of three to five years. You should definitely put money that you will need in the next several years for a specified reason in low-risk investments like a high-yield savings account or a high-yield CD.

How the stock market works

Investors can place bets on a company’s future on the stock market. The price at which investors are willing to buy and sell determines the overall value of the company. A stock’s performance is heavily influenced by market forces of supply and demand.

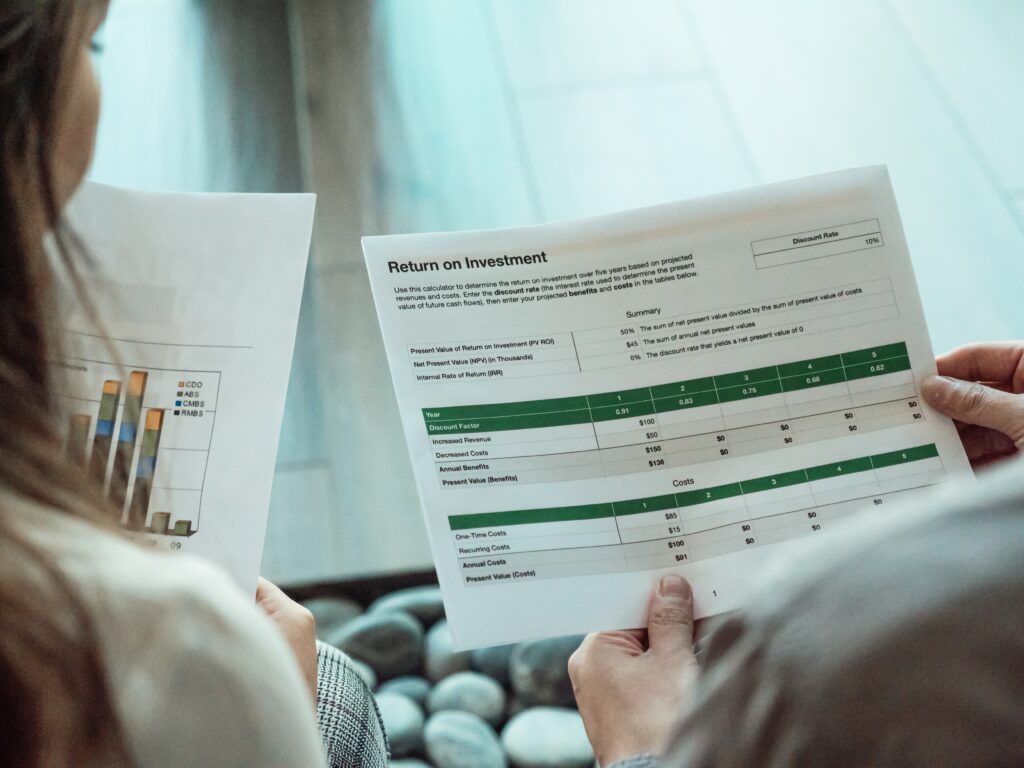

Risks and benefits of investing in stocks

In general, if bought at fair prices, equities make decent long-term investments. You won’t have to pay taxes on the gains if you don’t sell your shares. However, you will be required to pay capital gains taxes if you do make a profit from selling the shares.

Investors can profit from the stock market in two key ways:

- Purchase and hold an index-based stock fund, such as the S&P 500, to benefit from the long-term return of the index. Its return, however, might fluctuate significantly, going from down 30% in one year to up 30% in another. You can obtain the weighted average performance of the stocks in the index by purchasing an index fund.

- Purchase individual stocks, and look for those that will perform better than the average. This strategy is more riskier than merely purchasing an index fund and requires a great deal of expertise and understanding. However, your returns will probably be far higher than those of an index fund if you can find an Apple or an Amazon on the upswing.

Bottom line

Stock market investing may be quite profitable, particularly if you steer clear of some of the common mistakes that new investors make when they first start out. Beginners should develop a successful investing strategy and stick with it through good and bad times.

Leave a Reply

You must be logged in to post a comment.