A sort of financial chart used to monitor the movement of securities is one with candlestick patterns. They originated in the long-running Japanese rice trade and have since found their way into contemporary price graphing. Compared to traditional bar charts, some investors find them more visually appealing, and the price actions are simpler to interpret.

The rectangular shape and lines on either end of candlesticks give them their name since they resemble a candle with wicks. A day’s worth of price information on a stock is often represented by one candlestick. Investors can utilize the candlesticks’ gradual grouping into recognized patterns to decide when to buy and sell securities.

Key Takeaways

- Technical day traders can utilize candlestick charts to spot trends and make trading decisions.

- Bullish candlesticks refer to potential entry locations for long positions and can suggest when a downward trend is going to reverse itself.

- We discuss various illustrations of bullish candlestick patterns in this article.

Table of Contents

How to Read a Single Candlestick

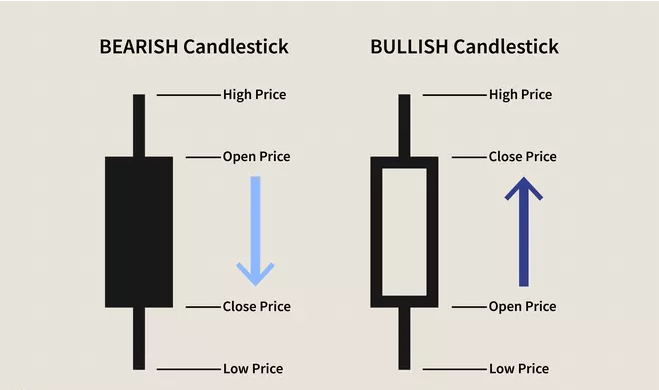

The starting price, closing price, high price, and low price are the four bits of data that each candlestick uses to represent one day’s worth of price information about a stock. Investors can detect whether the opening price or closing price was greater by looking at the color of the middle rectangle (also known as the genuine body). A black or full candlestick is bearish and denotes selling pressure since it suggests the closing price for the period was lower than the opening price.

A white or hollow candlestick, on the other hand, indicates that the closing price was higher than the opening price. This indicates purchasing pressure and is bullish. The shadows, which are the lines at either end of a candlestick, represent the full day’s range of price movement, from low to high. The stock’s top and lowest prices for the day are displayed in the upper and lower shadows, respectively.

Bullish Candlestick Patterns

Daily candlestick clusters eventually form recognized patterns with names that are descriptive—for example, three white soldiers, dark cloud cover, hammer, morning star, and abandoned infant. Patterns emerge over the course of one to four weeks and provide crucial information about how a stock’s price will move in the future. Note these two ideas before we examine specific bullish candlestick patterns:

- Within a downturn, bullish reversal patterns ought to develop. Otherwise, it’s a continuation pattern rather than a bullish pattern.

- Most bullish reversal patterns need additional bullish movement. To put it another way, they must be followed by an upward price movement, which can take the form of a gap up or a lengthy hollow candlestick and be accompanied by a large trading volume. Within three days following the pattern, this confirmation should be shown.

Other standard technical analysis tools, including as trend lines, momentum, oscillators, or volume indicators, can be used to validate the bullish reversal patterns and reaffirm purchasing pressure. There are numerous candlestick patterns that show a good time to buy. The five bullish candlestick patterns that provide the clearest reversal signal will be our main emphasis.

1.The Hammer or the Inverted Hammer

In a downtrend, the Hammer, a bullish reversal pattern, indicates that a stock is about to bottom out. The candle’s short body and extended lower shadow indicate that sellers drove prices down throughout the trading session, which was then quickly followed by intense buying pressure that caused the session to end with a higher close. However, we must first confirm the rising trend by attentively monitoring it over the course of the following few days, before we join in on the bullish reversal action. The increase in trade volume must also support the reversal.

An indication of a potential trend reversal or support is the Inverted Hammer, which also develops during downtrends. The only difference between it and the Hammer is the longer upper shadow, which denotes purchasing pressure after the opening price, followed by a lot of selling pressure, but not enough to lower the price below its opening value. Once more, bullish confirmation is needed; it can take the form of a gap up or a lengthy hollow candlestick and be accompanied by a high trade volume.

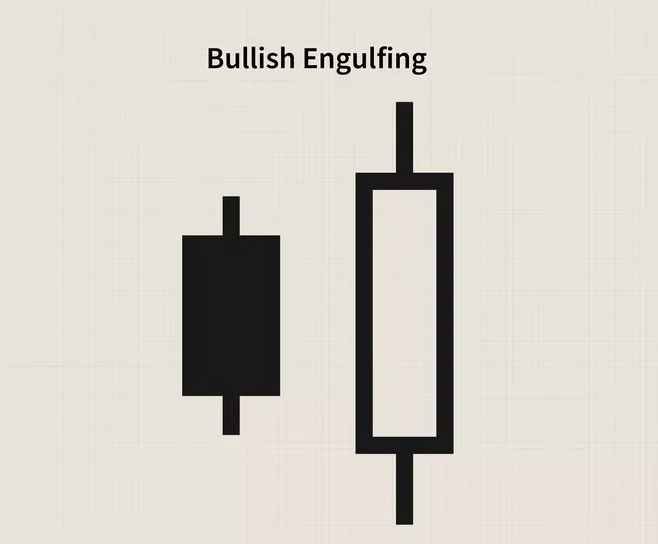

2.The Bullish Engulfing

A two-candle reversal pattern, the bullish engulfing pattern. Without respect to the size of the tail shadows, the second candle “engulfs” the genuine body of the first one completely. The Bullish Engulfing pattern, which consists of a smaller hollow candle followed by a larger black candle, appears during a downturn.The charge opens decrease than the preceding low at the pattern’s 2d day, however shopping for strain reasons it to upward thrust to a more stage than the earlier excessive, ensuing in a clean victory for the buyers. When the charge surpasses the excessive of the second one engulfing candle, or while the downtrend reversal is verified, it’s far suitable to open a protracted trade.

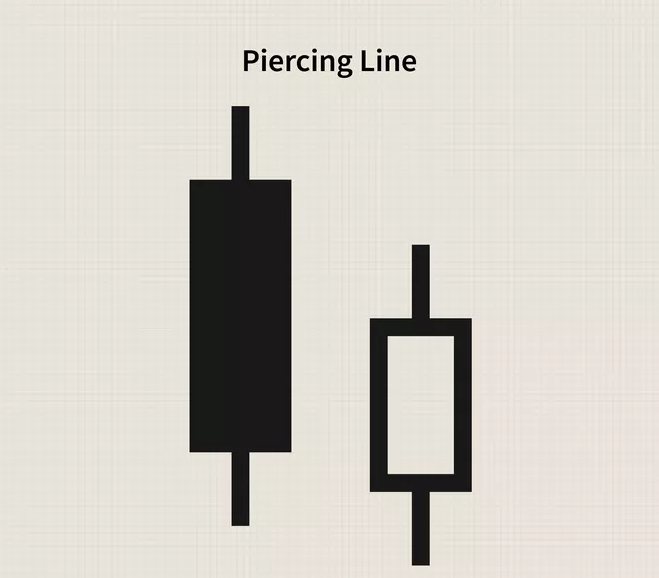

3.The Piercing Line

The Piercing Line is a two-candle bullish reversal pattern that also appears in downtrends and is similar to the engulfing pattern. Immediately after the initial lengthy black candle, a white candle that opens lower than the preceding close is lit. Soon after, the price is pushed up into the main body of the black candle by the buying pressure, preferably two thirds of the way.

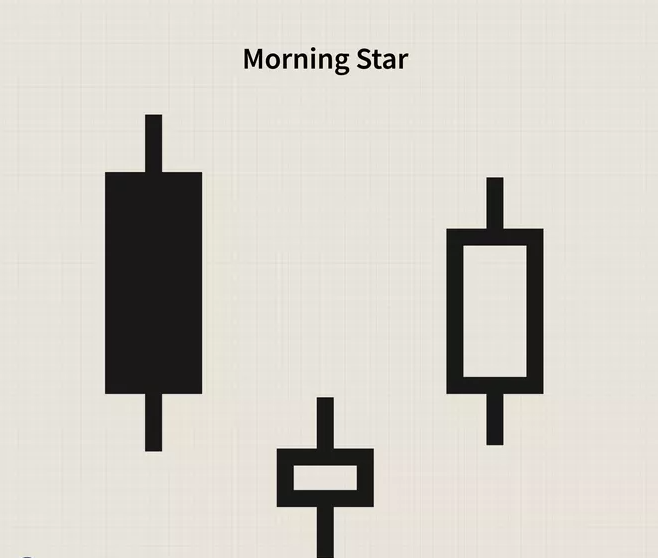

4.The Morning Star

The Morning Star, as its name suggests, is a symbol of new beginnings and hope in a depressing downward trend. Three candles make up the pattern: a short-bodied candle (also known as a doji or a spinning top) between an earlier long black candle and a later long white candle.

The quick candle’s real frame may be both white or black, and there’s no overlap among it and the black candle earlier than it in phrases of color. It demonstrates that the promoting stress from the day earlier than has subsided.A bullish reversal is beginning, as evidenced via way of means of the 1/3 white candle, which engulfs the frame of the black candle and shows clean consumer stress. This is particularly authentic if the bigger extent is present.

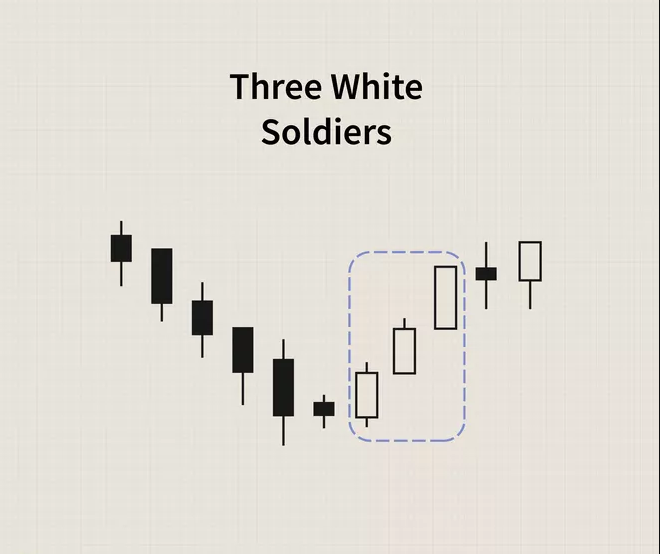

5.The Three White Soldiers

Following a downtrend or during a price consolidation, this pattern is typically seen. It consists of three lengthy white candles, each of which closes higher than the previous day’s closing price. Every candle displays a continuous increase in purchasing pressure by opening higher than the previous open and closing close to the day’s high. When white candles seem to be lasting too long, investors should exercise caution as this could tempt short sellers and drive the stock price even lower.

Putting it All Together

Three of the bullish reversal patterns mentioned above—the Inverted Hammer, the Piercing Line, and the Hammer—can be seen in the chart below for Enbridge, Inc. (ENB).

The Three White Soldiers pattern is displayed on the Pacific DataVision, Inc. (PDVW) chart. Take note of how the sudden spike in trade volume supports the downtrend’s reversal.

The Bottom Line

Candlestick charts are a technical evaluation device that buyers need to appoint similar to any other (i.e., to look at the psychology of marketplace individuals withinside the context of inventory buying and selling). In addition to the simple evaluation that serves as the muse for buying and selling decisions, they provide an extra layer of evaluation.

Five of the more well-known candlestick chart patterns that suggest purchasing opportunities were examined. They can assist in spotting a shift in traders’ attitudes when buyer pressure prevails over selling pressure. A possibility for long gains can accompany such a downtrend reversal. Despite this, the patterns do not ensure that the trend will change. Before entering a trade, investors should always verify a reversal by the subsequent price movement.

Important-:Market forecasting techniques do exist, however technical analysis is not necessarily a reliable predictor of success. In either case, you’ll need a broker account to invest. To obtain a sense of the best options available, consult Investopedia’s ranking of the best online stock brokers.

Frequently asked questions

What is the most successful candlestick pattern?

Doji. The doji, one of the most significant single candlestick patterns, can provide you with information about the mood of the market. When a stock’s opening price and closing price are the same, dojis are said to form.

Can we use candlestick patterns for day trading?

A daily candlestick displays the market’s open, high, low, and close prices for the day, just like a bar chart does. The “true body” of the candlestick is the candlestick’s widest portion. The price range between the opening and closing prices of that trading day is represented by this real body.

Editor’s choice:

What’s The Difference Of Bullish vs. Bearish Investors? 03rd Topic Is Best